Helpful Colin Presents A World of Information

-

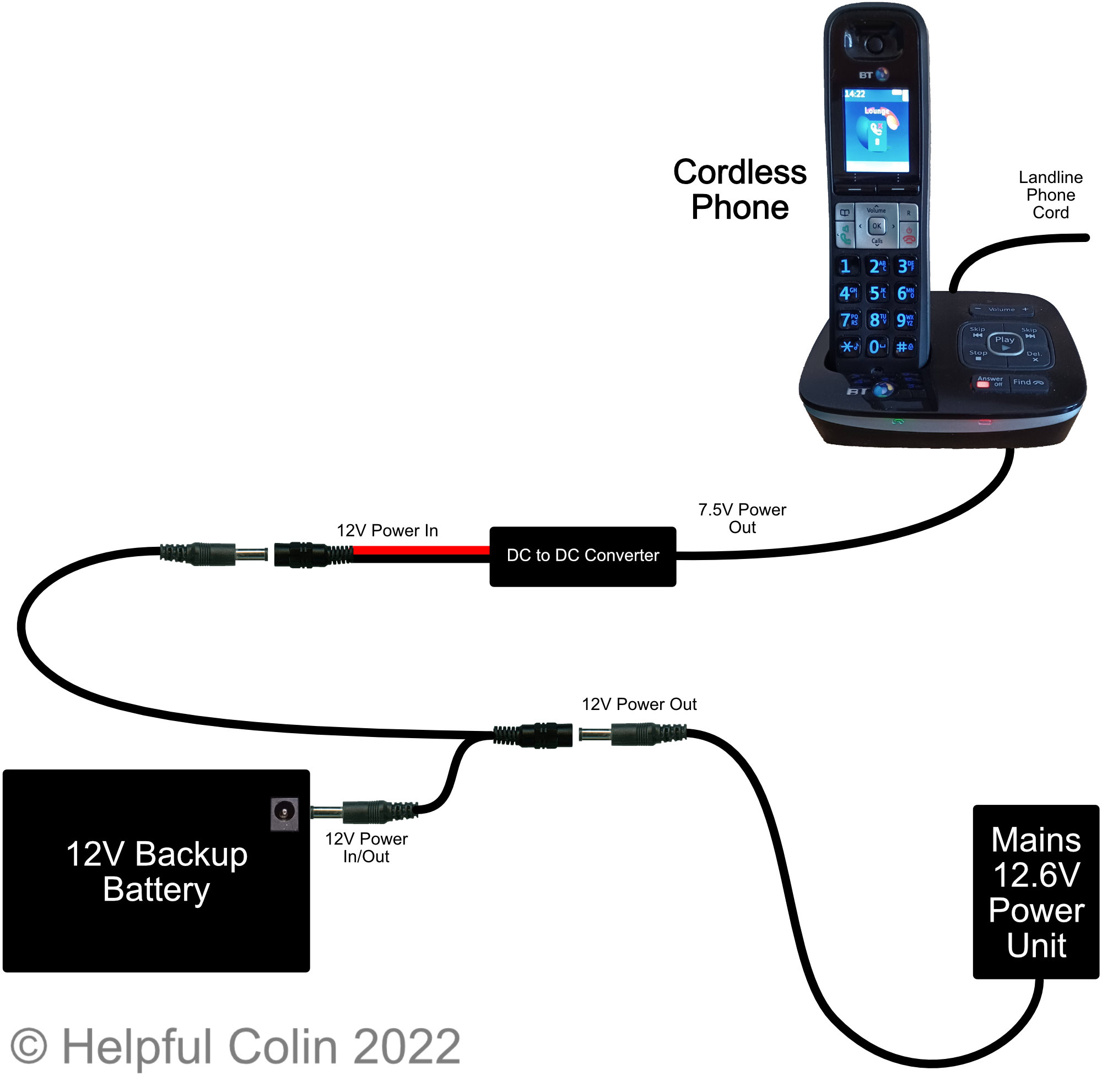

I Have A Battery Backing Up My Cordless Phone

Introduction Cordless Phones have always been susceptible to power cuts, since they don’t generally come with a battery backing up the Base Unit. It’s expected that users provide a basic phone which can be plugged into the line in an emergency. In the past this phone would have been powered by the 50V exchange battery…

-

Test Post

This is just a test post.

-

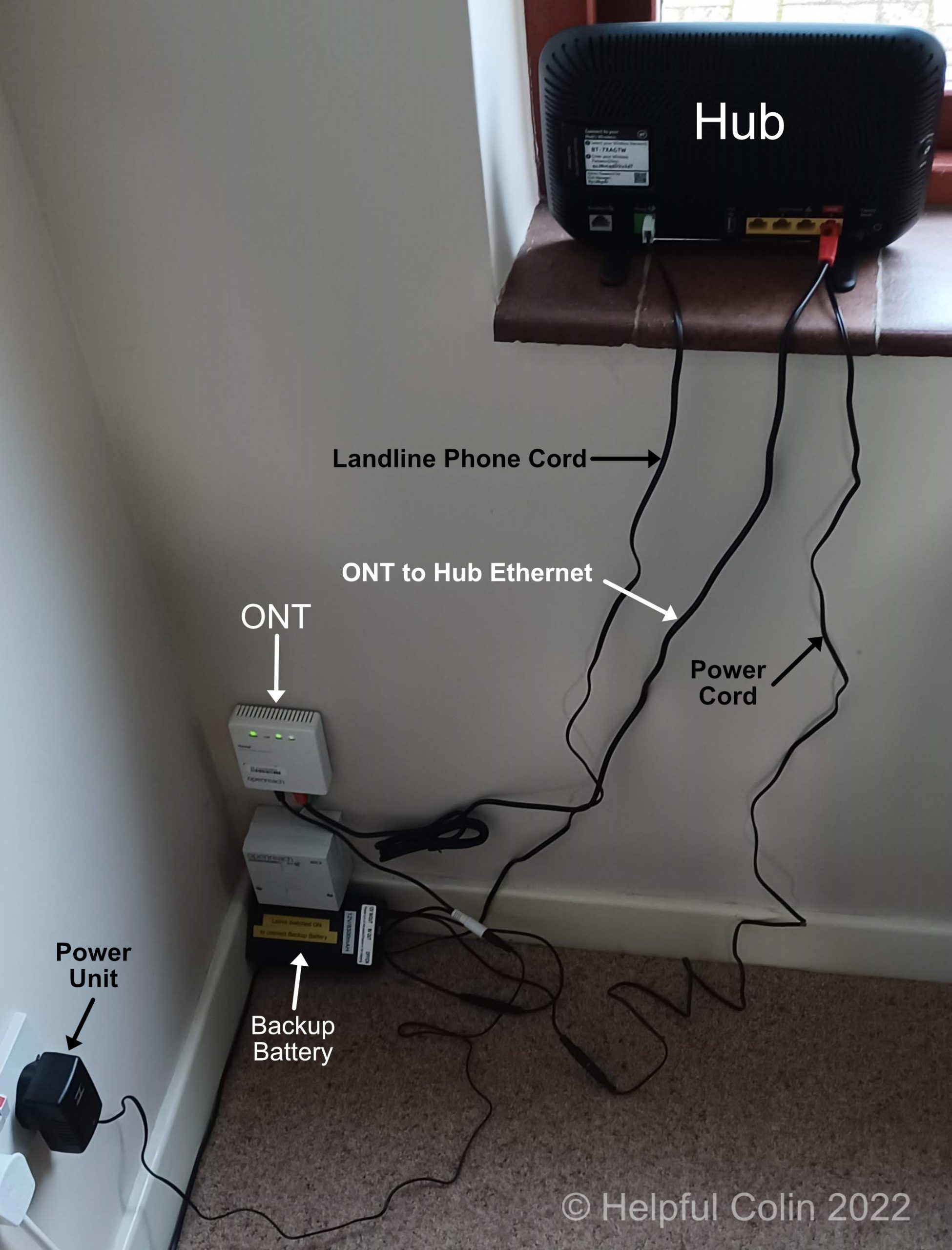

My Broadband Hub & Phone Have A Backup Battery

To guard against power cuts this winter I have given my Broadband Hub and fibre to ethernet interface (ONT) a 3-hour Backup Battery.

-

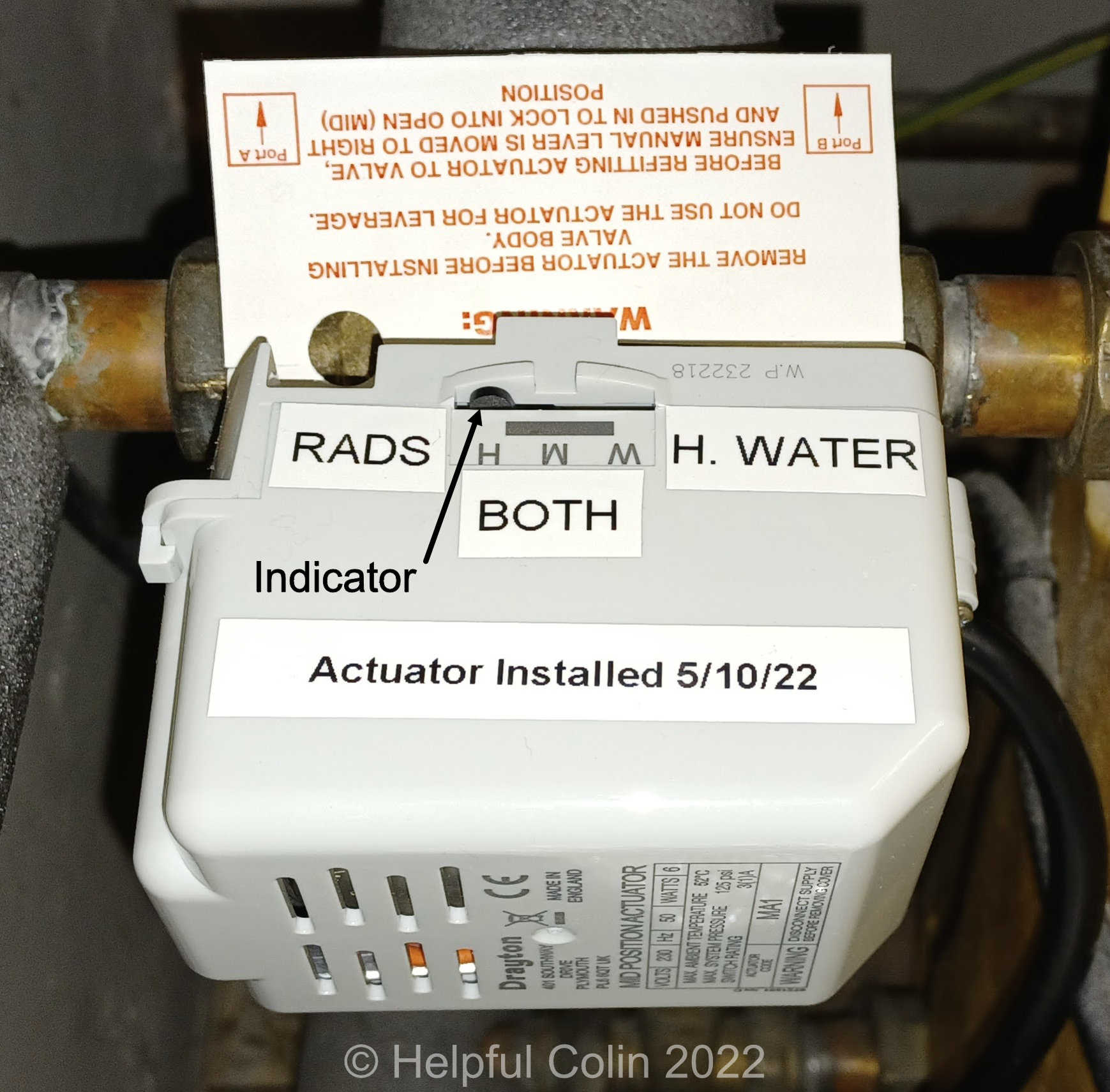

Changing A 3-Port Valve Actuator in A Central Heating System

Over time valve actuators may develop faults which are easily fixed by replacing them. I have just had to do that with the one in my central heating system. I last changed it on 12th December 2017, so, it had run for nearly five years without a fault.

-

How To Vent Portable Air Conditioner Exhaust

I’ve been thinking of obtaining some air conditioning equipment for the last few years since 2018. But this year (2022), with exceptional heat forecast and my son taking similar action to cool his London flat, I went ahead and bought an AEG CHILLFLEX portable air conditioner.

-

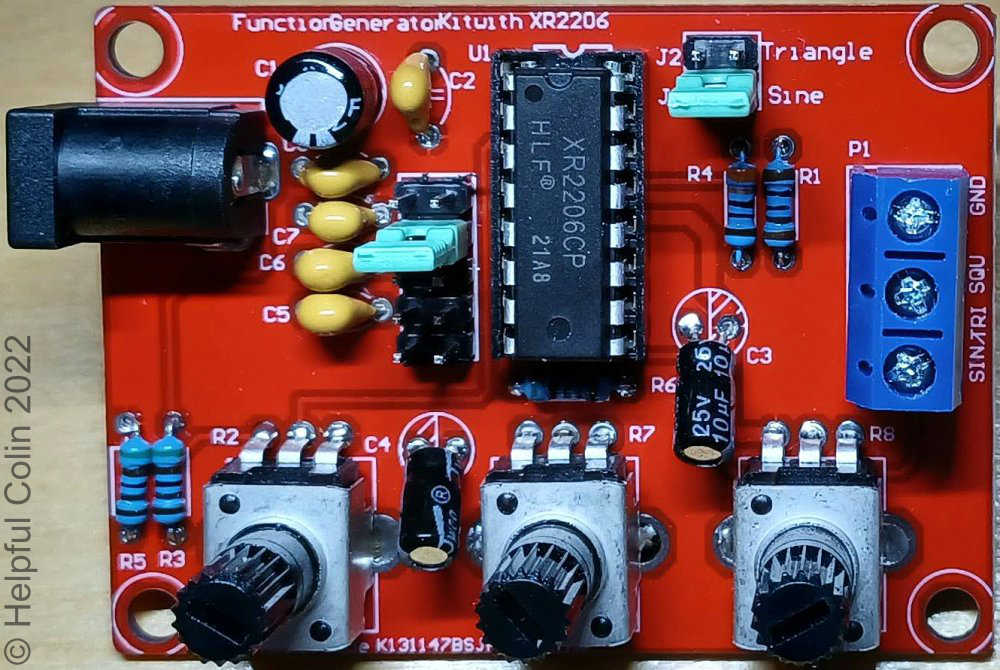

A Function Generator Built From A Kit Using An XR2206

Introduction This post covers some of the practicalities that have to be met when building a function generator (signal generator) using an XR2206CP Function Generator kit. I assume anyone building one of these kits has some electronic and soldering experience. The Kit Instructions I bought two of these kits and I could see immediately, when…

-

XR2206 Function Generator Kit Improved Instructions

Introduction The XR2206 Function Generator Kit is available through various outlets at a selection of prices up to £13. I got one branded “ARCELI” via Amazon for £7.99. Having got one, I would advise getting the cheapest one you can. Just take into consideration the trustworthiness of the seller to be sure you get what…

-

Microwave Inverter Repairs To The Door Button & Bezel

The large rectangular button used for opening the door began protruding at the righthand end by about five millimetres. Obviously it had broken.

-

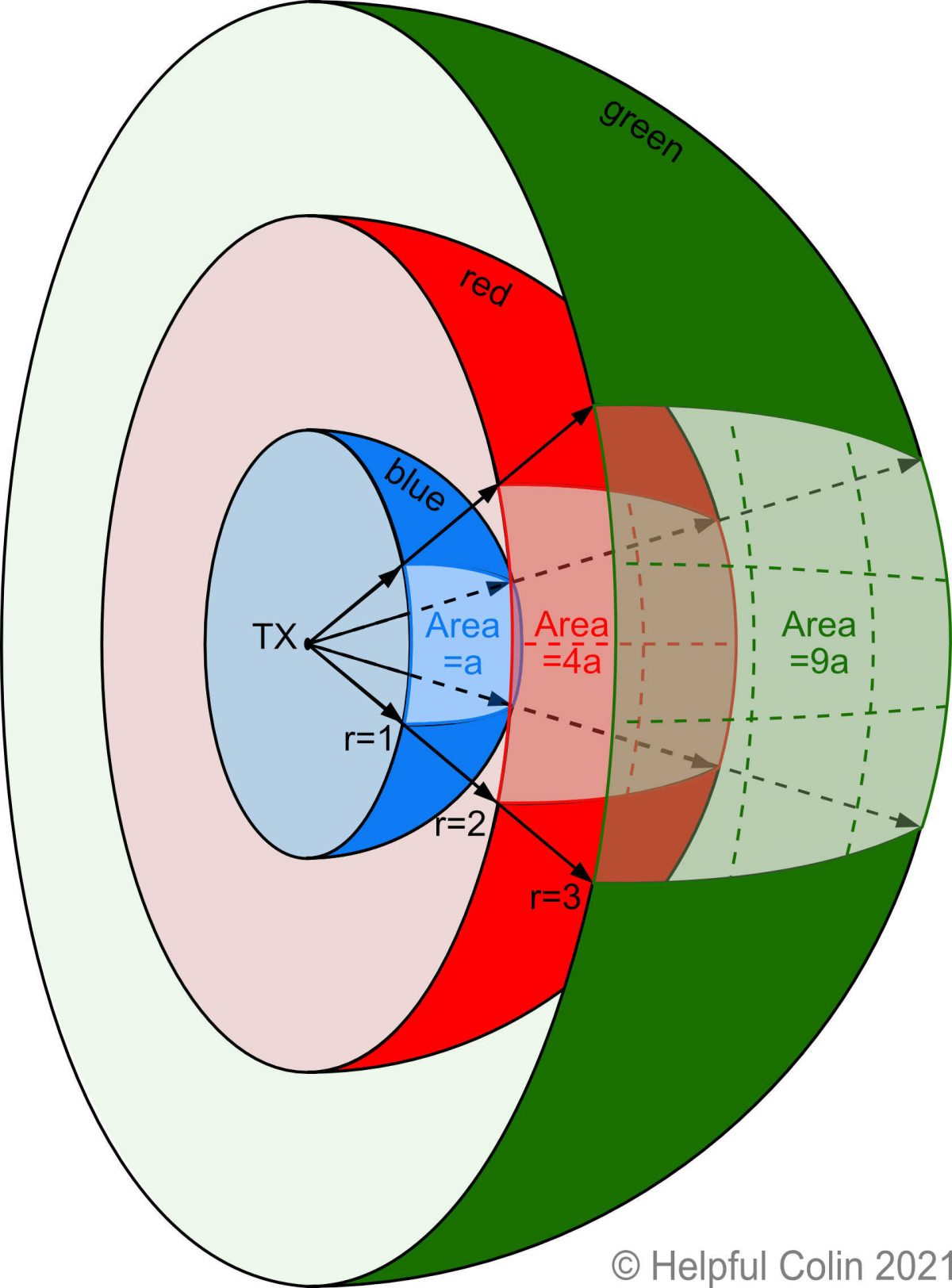

Radio Wave Power And How It Gets Reduced By Distance

Some people are very concerned that radio wave power coming from radio transmitters’ antennas will harm people. In particular people are troubled by mobile phone masts causing long term health problems when they are near to their homes. I just want to make it clear how much a transmitter’s power diminishes as it spreads out…

-

An Explanation of Direct And Inverse Proportion

Introduction At least one of my other posts How Distance Reduces The Power of Radio Waves requires an understanding of mathematical proportionality. In particular it requires an understanding of Inverse Proportion. So I have written this article to try and clarify it. It gives an explanation of the two types of proportion, otherwise known as…

-

Using A Milk Bottle As A Plant Pot Reservoir

Introduction If I water plant pots in dry weather the water runs over the top of the soil to the edge of them. Then, because the dry soil in the pot has shrunk, the water runs down a gap between the soil and the pot side. When the water gets to the bottom of the…

-

Autumn Steam Gala 2019 At The Great Central Railway

Introduction Another trip to Loughborough and another Steam Gala. The GCR keep coming up with them. This Autumn Steam Gala 2019 was a four day event from 3rd to 6th October 2019. That’s Thursday through to Sunday. I visited with a couple of friends on Friday 4th, arriving just before 09:00 BST.

-

Draping A Christmas Garland Over A Mirror or Picture

Introduction It was a few Christmases ago when my wife and I first draped a Christmas Garland over the mirror in our lounge and another over the mirror in the hall. The garlands we bought were fashioned very much to our liking. They just looked like Christmas and became one of those purchases made without…

-

14 Pin & 15 Pin D Connectors on VGA Cables

Introduction I wanted to know what the difference is between VGA cables with 14 pin and 15 “D” connectors. I found the answer on the Instructables site/forum. The info I needed was contained in a reply to a query by onrust circa 2010.

-

How I Hung My Vertical Radiator In The New Lounge

Introduction I hung my vertical radiator in the new lounge while the builder of my extension and his plumber were busy doing other work. They let me do this because I explained my concerns about its weight and agreed to try fixing it by their method. I explained what I planned to do if, when…

-

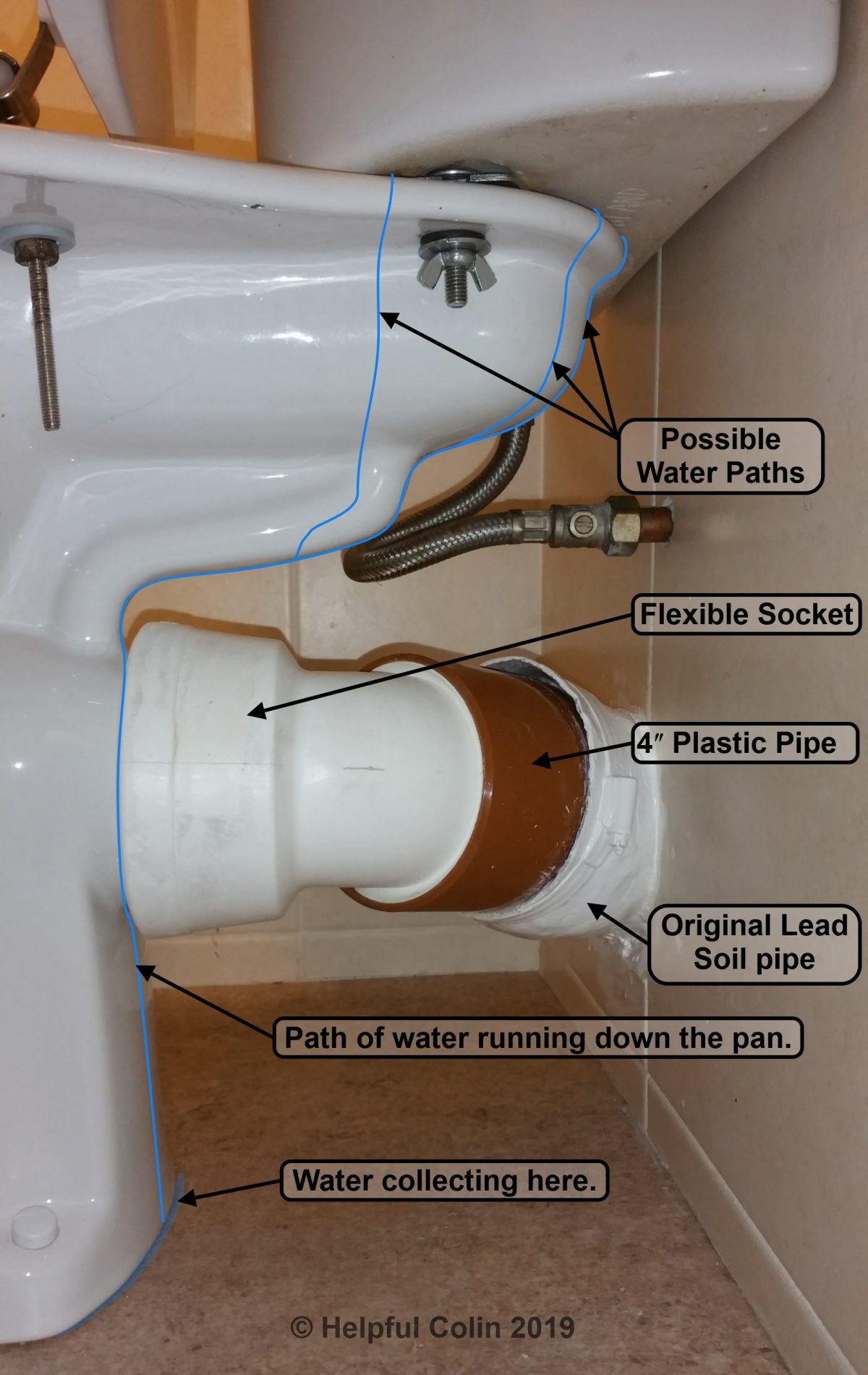

Fixing A Close Coupled Toilet Leaking Fresh Water

Post Description How I renewed the coupling kit which joins my toilet cistern and pan. I did this to repair a Close Coupled Toilet leaking fresh water between the cistern and pan. Water was leaking from the coupling joint when the toilet was flushed.

-

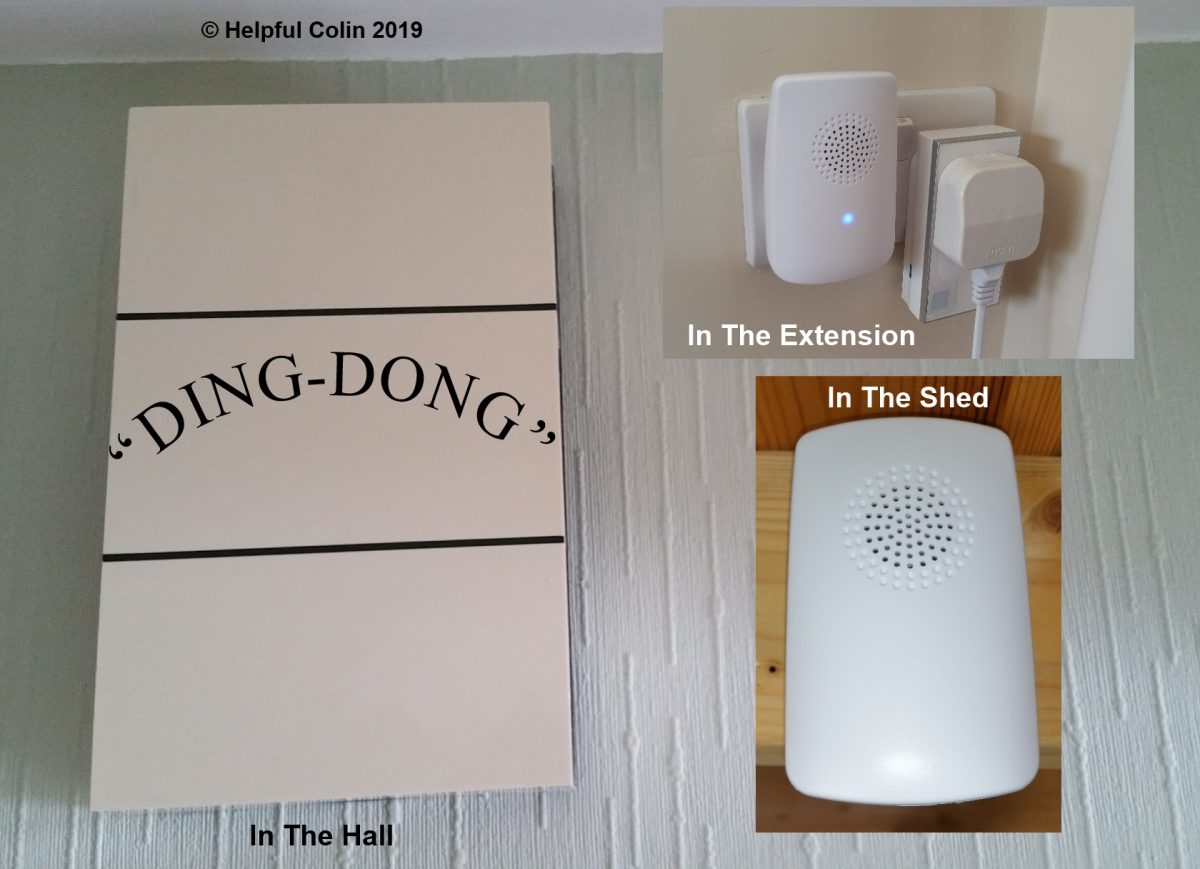

Extending The Door Bell In My Home

Post Description I’ve been extending the door bell in my home so it can be heard in the house extension and shed. It’s been done by incorporating wireless technology, while retaining my original 1980s “DING-DONG” door chime which had a great sound and an illuminated bell push.

-

Converting A Bell Push Light To LEDs

Post Description How I replaced an incandescent bell push light with LEDs. The bell push operates a door chime powered by AC from a bell transformer.

-

I Built A Riven Patio Extension For My House Extension

Post Description How I extended an existing patio in front of a new ground floor house extension. I talk about matching the the new slabs with the originals and keeping the pattern random. It also tells how I put a curved wave in the edge to match other curves and create a pleasing shape to…

-

Cooling Fan Lubrication For An NVIDIA GeForce GTS240

Preface This post describes: My success at cooling fan lubrication on an NVIDIA GeForce GTS240 PC display adapter to silence it when it became noisy.

-

A Twin Towel Rail System Prevents Towels Slipping Off

Preface This post describes: How a Twin Towel Rail system with towels wrapped around two rails parallel to each other will not easily fall off onto the floor.

-

Restoring A Remploy Stowaway Wheelchair

Preface This post describes: How I restored a Remploy Stowaway Wheelchair whose tyres and arm rests had deteriorated with time in a hot loft atmosphere. The rest of it was in excellent condition and it now functions like it did when it was new.

-

Not Enough Gift Wrap For That Gift? Wrap It Diagonally.

Introduction You start off with a nice roll of Gift Wrap, when you wrap those gifts for that festive occasion, and afterwards you have a small rectangle of unused paper left over. Eventually another small gift needs wrapping so you look through the small left-over pieces of Gift Wrap only to find several are nearly…

-

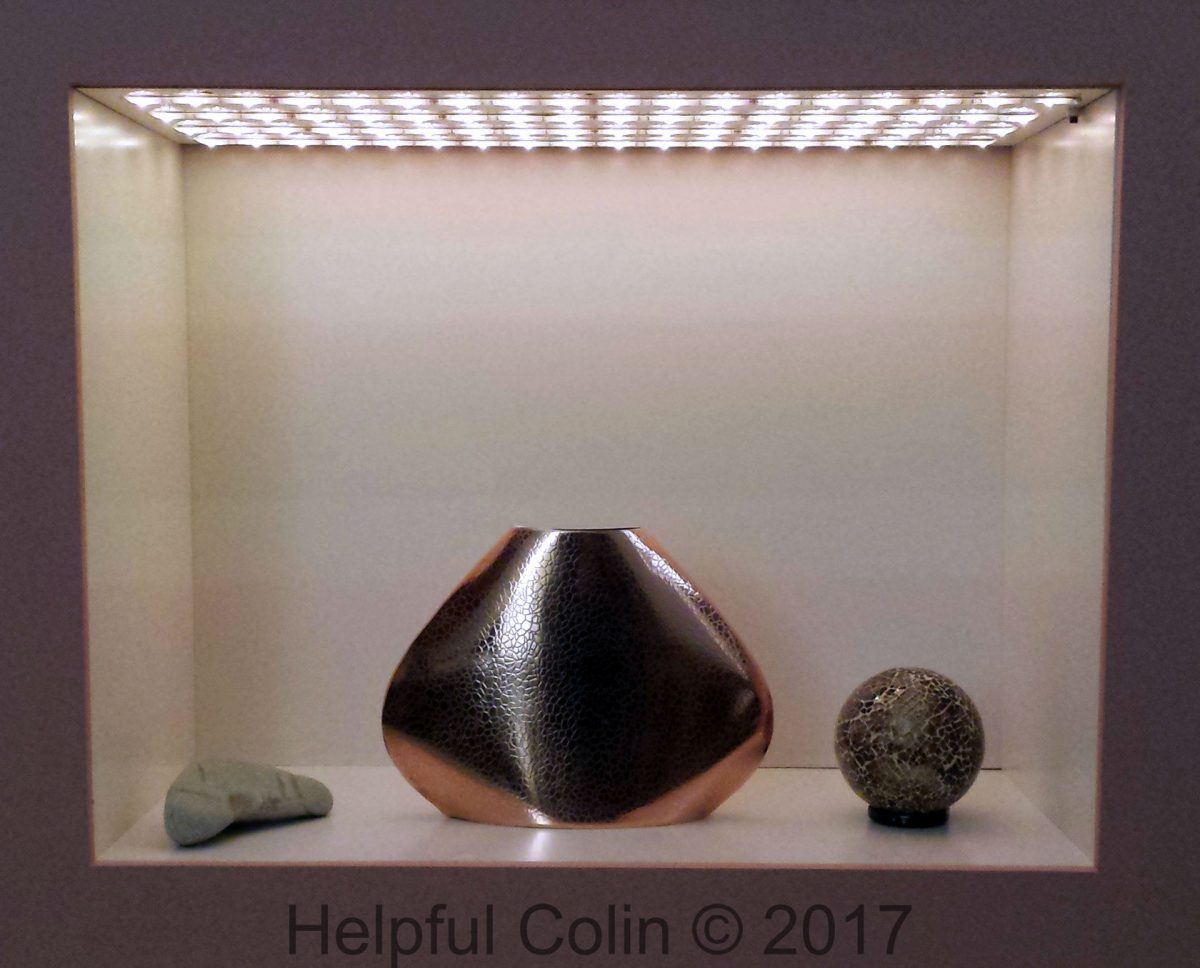

A Fireplace Alcove Coloured Lighting Scheme

Introduction Here I will describe how I created a Fireplace Alcove Coloured Lighting Scheme using multi-coloured LED lighting. This article isn’t about lighting a small niche in the wall of a large Ingle Nook fireplace or anything like that. It’s about converting a modern domestic fireplace into an alcove where ornaments or a plant could…

-

Is My Dualit Model DMF2 Milk Frother Corroding?

Introduction Unfortunately besides my Dualit Milk Frother requiring a repair (see How I Repaired A Dualit Milk Frother Model DMF2) another problem has developed. I have to ask, “Is my Dualit Milk Frother corroding?” If not what is happening to it. Is the brown mark I can see copper or rust?

-

Dog Fouling Statistics

Preface This post just brings to light matters which become obvious when calculations are made regarding the number of deposits dogs can make in their lifetimes. It doesn’t discuss dog fouling statistics regarding quantity as would be expected if weight measurements had been taken.